- +91 8069578175

- marketing@peorient.com

Over the last few years, India’s stock market has grown significantly. Global Head of Equity Strategy at Jefferies, Christopher Wood, claims India is still in the early phases of building an equity culture. This paper investigates the elements behind this increase and the possible effects of forthcoming budget cuts on the market.

The Raising Involvement of Retail Investors

On India’s stock market, retail investors now hold a commanding presence. Their increasing involvement—including mutual fund investments—has helped to explain the market’s resiliency. Wood underlines that the participation of regular investors will probably keep increasing, so the Indian stock market presents an engaging worldwide narrative.

Trend in Ownership

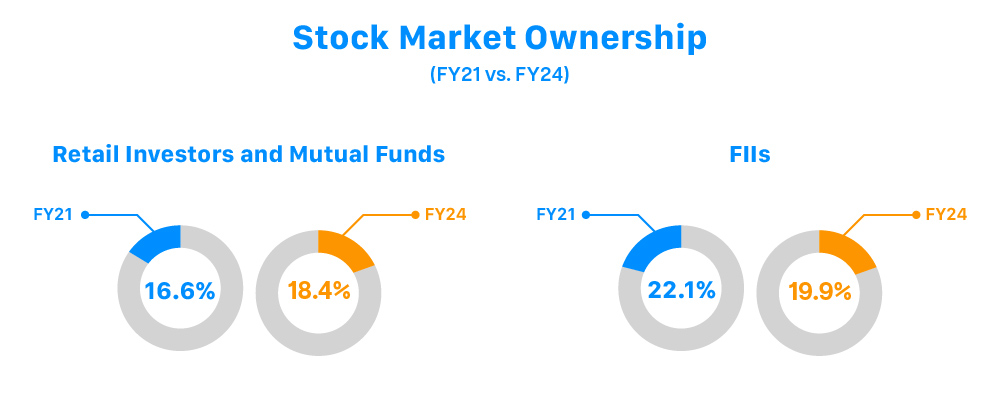

Ownership records show this change. From 16.6% at the end of FY21 to 18.4% at the end of FY24, retail investors’ ownership of stocks has changed. Mutual funds own equities. By comparison, over the same period, the ownership of Foreign Institutional Investors (FII) has dropped from 22.1% to 19.9%. This change emphasizes the rising internal push of the Indian market.

Market Capitalization and Increase

From $1.3 trillion in March 2020 to $5.2 trillion, the capitalization of the Indian stock market has surged 296%. Rising from 0.93% in March 2020, it currently makes 1.96% of the MSCI AC World Index. This expansion demonstrates the market’s increasing impact and appeal to investors.

Gross Domestic Product Ratio

From 52% in March 2020 to 145% right now, the market capitalization to GDP ratio has also changed dramatically. Although this suggests that the market is no longer cheap, Wood contends that, save for tactical or short-term needs, this does not justify selling. His portfolio has a 26% allocation in India, therefore demonstrating his faith in the long-term viability of the market.

Budget 2024: possible consequences

Issues of Populism

One important event to keep an eye on is the forthcoming Budget 2024, set on July 23. Wood says the budget may feature populist policies meant to satisfy minority party aspirations inside the BJP coalition. However, he thinks that the allocation for such initiatives would be smaller than expected.

Tax on capital gains

One of the main issues is a possible rise in the capital gains tax rate. Although there is less concern about this than in past times, any notable increase might set off a significant market drop. Wood reports that the market was recovering by 13.3% after the recent Lok Sabha election, which had a minor pullback following the election. Retail investors bought as pros sold accounts for this resiliency.

Long-Term Integrity and Confidence in Rupees

The rising trust of domestic investors in the long-term stability of the rupee is another critical element. A steady or appreciating currency accentuates the appeal of Indian stocks, hence supporting the market’s domestic demand-driven story.

Future Outlook

Wood still sees great promise in India’s stock market and calls it the most attractive asset management narrative available worldwide. Notwithstanding temporary difficulties, the increasing involvement of retail investors and developing domestic confidence help to shape the market for further expansion.

Conclusion

Driven by higher individual investor involvement and rising domestic confidence, India’s stock market is in the early phases of an equity culture. The market’s potential is shown by its outstanding capitalization increase and resistance to political uncertainty. Investors will be especially intently observing any changes in capital gains tax and populist policies as Budget 2024 draws near. Still, India is an exciting place to invest as the long run looks bright.