The Benefits and Drawbacks of the Gig Economy

The gig economy has transformed modern employment, offering both opportunities and challenges for workers worldwide.

Organizations are always seeking fresh approaches to grow outside of their own nation as the corporate world grows more international. An increasingly attractive substitute is using an International Professional Employer Organization (PEO), which is becoming increasingly well recognized. But what is an International Professional Employer Organization, and why is it so crucial for companies looking to expand internationally? Let us immediately dive into this fascinating topic.

For what does PEO stand? Professional Employer Organization is shortened to “PEO.” By offering companies complete human resources services, these companies function as outsourced human resources department. Among their many duties include payroll processing, benefit administration, HR compliance, and more.

For what does PEO stand? Professional Employer Organization is shortened to “PEO.” By offering companies complete human resources services, these companies function as outsourced human resources department. Among their many duties include payroll processing, benefit administration, HR compliance, and more.

One type of PEO, called an International PEO, carries the traditional PEO model across national boundaries. A standard PEO works within a single country; an international PEO helps companies manage their staff who are dispersed throughout several nations. Oversight of local compliance, payroll, benefits, and other human resource services globally is part of this position.

Working with an International PEO offers several benefits, one of which is the simplicity with which new markets can be reached. To handle their local employees, companies can establish contacts with PEOs abroad. This is an option for forming a legal company in every state. Global expansion now requires far less time and complexity.

Getting around the legal system of a foreign country could be challenging. By guaranteeing adherence to local labor rules and regulations, companies that use an international PEO reduce their risk of running into legal problems and paying fines.

Starting a foreign subsidiary can be a costly undertaking. One benefit of a less expensive option is that an International PEO does away with the requirement for a physical presence in the nation. Business can therefore better and more successfully manage its resources.

Employers who engage an international PEO have access to a wide range of talent from all around the world. Apart from helping to identify the pertinent talents, this presents a range of viewpoints that might stimulate progress and creativity.

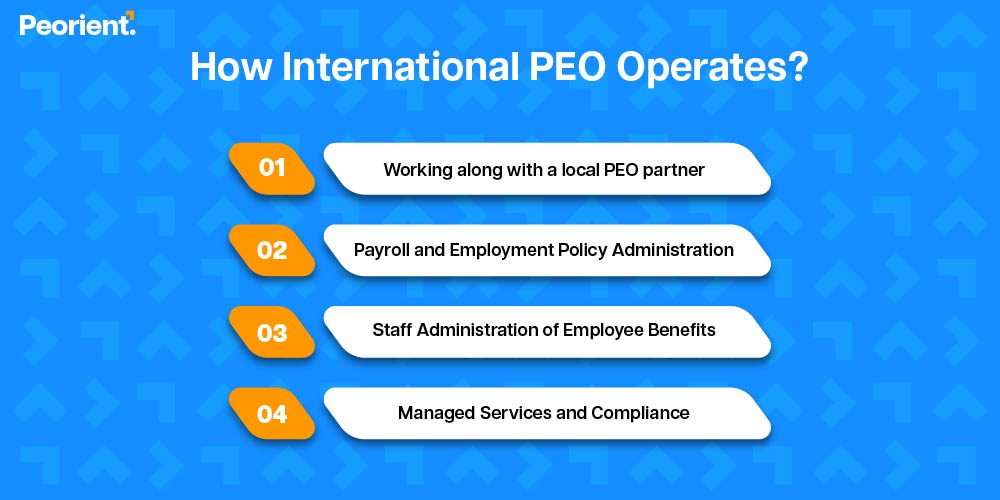

Each place they conduct business, international PEOs work with local organizations. These local bodies carry out daily work duties and make sure that local regulations are followed.

Every facet of employment and payroll is handled by the PEO, including tax withholding, paycheck distribution, and timely payment of employees.

An International PEO offers retirement plans and health insurance among other perks to its staff. These advantages are catered to the requirements and expectations of the specific market niche.

We offer ongoing human resources support to handle any problems that could come up and to make sure that all hiring procedures follow local laws.

Traditional and international PEOs offer somewhat different human resource management services. A traditional PEO is exclusively in charge of activities inside one country, unlike an international PEO who operates in several nations. There exist several applications: For domestic operations, the traditional PEO is a great option; but, if a company wants to grow internationally but does not want to deal with the inconvenience of creating external organizations, the international PEO is a great substitute.

Traditional and international PEOs offer somewhat different human resource management services. A traditional PEO is exclusively in charge of activities inside one country, unlike an international PEO who operates in several nations. There exist several applications: For domestic operations, the traditional PEO is a great option; but, if a company wants to grow internationally but does not want to deal with the inconvenience of creating external organizations, the international PEO is a great substitute.

India is a desirable choice for companies who want to go beyond their current location because of its fast growing economy and large talent pool. But negotiating the intricate legal system and varied cultural enviornment can be difficult. An significant player in this field is the International Professional Employer Organizations (PEOs). Firms can establish a presence in India without having to register a formal business with an International PEO. This assures that they follow national laws and expedites the process of expanding their company.

Among the various benefits of using an international PEO in India is the ability to quickly and effectively onboard employees. The PEO handles benefits administration and payroll processing among other facets of employment. This ensures that benefits and salaries of employees comply with Indian laws. This not only saves time but also lessens the administrative work for the internal human resources staff of the organization.

Sustaining compliance rules is another important advantage. Indian labor regulations are complicated and state-by-state different. An International PEO is qualified to oversee these rules and make sure businesses keep following them, therefore preventing expensive legal problems. Major human resources support from PEOs also helps to resolve employee grievances and fosters a positive work environment.

Companies may easily manage their employees in India, guaranteeing compliance with local legislation and fostering a productive and happy work environment, by using the services of any of these large multinational PEOs.

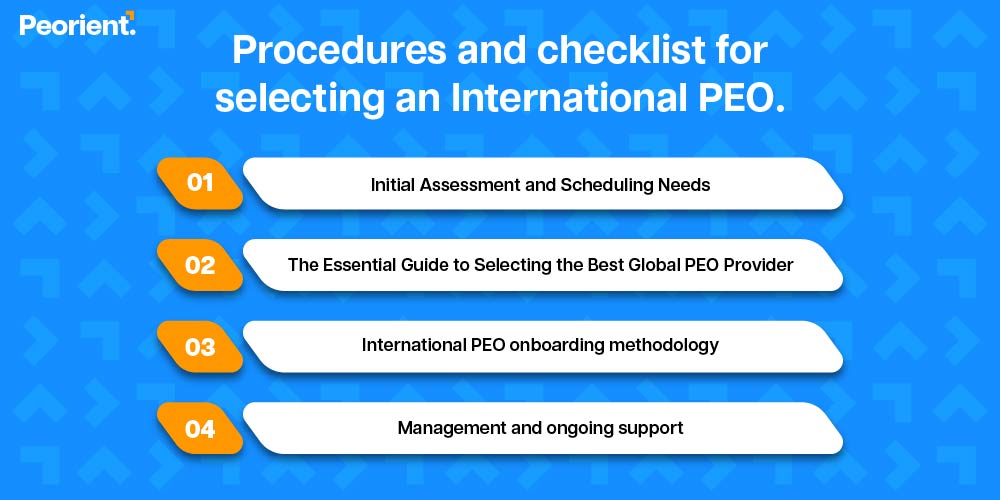

Determine which nations you wish to grow into and evaluate the demands of your business to get started.

Select a service provider that knows and has a proven track record of success in the markets you wish to enter. Think on their prices as well as the services they offer.

Once a provider has been chosen, the onboarding procedure will get underway. This covers payroll and benefits setup as well as moving your staff to the local businesses of the PEO.

To guarantee operations operate well and local regulations are met, the PEO will manage all human resource tasks and offer continuous support.

Labor laws vary among countries and might be perplexing. Keep yourself updated even though an International PEO can assist you with these issues.

It is imperative that managers of a worldwide workforce acknowledge and value the many cultural variations that occur. Good training and communication can help to overcome cultural obstacles.

When languages are different, misinterpretations might happen. Working with a PEO who provides support in several languages could be helpful in resolving these problems.

Managing a worldwide team means taking into account the problem of several time zones. Good communication and wise scheduling will get you over this obstacle.

Using an international PEO is usually less expensive than paying legal fees, office rent, and other costs associated with starting a foreign subsidiary.

A corporation must navigate a complicated web of legal and regulatory procedures in order to successfully establish its international operations. An International Professional Employer Organization (PEO) is crucial for tackling these concerns. This is especially true when dealing with the myriad local labor standards that govern employment contracts, working hours, and termination provisions. An International PEO will guarantee that all of these areas conform with local legislation, resulting in a smooth expansion process.

Every country has its own labor regulations, which might differ quite a deal from one government to another. For example, labor rules in India are highly severe and vary by state. These problems are made easier for firms to manage with the support of an international PEO, who ensures compliance with all local norms. In this manner:

By managing these key parts of employment law, an international PEO not only assures compliance but also allows firms to focus on their core operations without being burdened down by regulatory constraints.

Myth: Smaller organizations find it to be unaffordable.

International PEOs are cost-effective and may provide scalable solutions, which benefits organizations of all sizes.

Myth: HR departments within can be replaced by it.

By handling administrative and regulatory tasks, PEOs help HR departments concentrate on strategic goals.

Myth: Big companies can only use it.

All kinds of companies might gain from the services of an international public accounting firm (PEO), especially when entering new areas.

Companies that want to grow internationally but don’t want to deal with the burden of establishing foreign subsidiaries should definitely consider international PEOs. Managing local compliance, payroll, and human resources services enables businesses to concentrate on their main activities and expansion. Global expansion and new market access can be facilitated by an International Professional Employer Organization, regardless of the size of your business.

"Talented writer dedicated to delivering high-quality content that drives results."

International PEO will help companies of all sizes who wish to expand into new foreign markets without establishing formal enterprises.

A few weeks to many months may pass, depending on how complicated the case is and how many countries are involved; however, Remunance assured us of onboarding within a few days!

In sectors like information technology, healthcare, and services—all of which have seen tremendous worldwide growth—international PEOs are extensively employed.

Indeed, International PEOs can oversee staff members in several nations simultaneously, guaranteeing uniformity and compliance across national boundaries.

Local human resources assistance from the International PEO is available to handle any employee concerns and guarantee that they are handled in accordance with local law.

The gig economy has transformed modern employment, offering both opportunities and challenges for workers worldwide.

Within the next two and a half years, Ford Motor Company wants to introduce an all-electric vehicle that costs $30,000.

Within the next two and a half years, Ford Motor Company wants to introduce an all-electric vehicle that costs $30,000.