Employer of Record China: Reviewed in 2026

Employer of Record (EOR) services in China help companies hire and manage employees without setting up a local legal entity. EOR providers handle payroll, taxes, benefits, contracts, and compliance with Chinese labor laws, enabling rapid and compliant workforce expansion.

- January 28, 2026

Employer of Record China: Reviewed in 2026

Employer of Record (EOR) services in China help companies hire and manage employees without setting up a local legal entity. EOR providers handle payroll, taxes, benefits, contracts, and compliance with Chinese labor laws, enabling rapid and compliant workforce expansion.

- January 28, 2026

China offers access to one of the world’s largest talent pools. Skilled engineers, operations specialists, and manufacturing professionals are abundant. Yet, navigating employment rules can be complex. Payroll, contracts, visas, and local regulations vary by city.

For companies expanding into China, these complexities create real challenges. Setting up a legal entity takes time and money. Missteps in compliance can lead to fines or legal exposure.

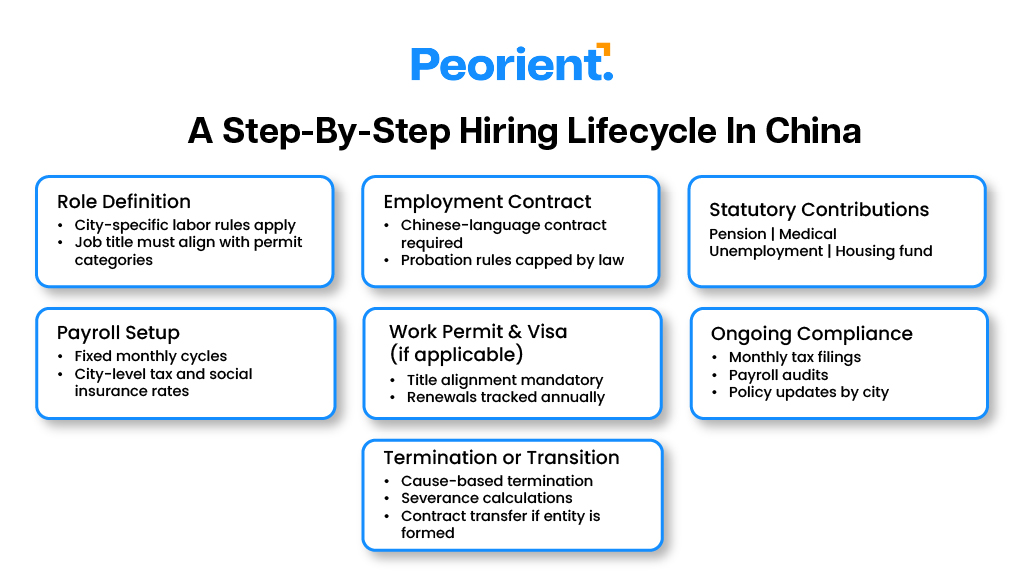

An employer of record China solution allows businesses to hire local employees quickly and compliantly. The EOR handles contracts, payroll, taxes, and work permits. This enables companies to focus on growth while reducing operational risk.

This guide reviews the employer of record services China offers in 2026. It focuses on how these services actually work on the ground. It highlights strengths, limits, and trade-offs.

What Is an Employer of Record in China?

An employer of record in China is a local entity that legally employs workers on your behalf. The employee works for you operationally. The EOR manages employment legally.

The EOR signs the labour contract. It processes payroll. It pays taxes and social insurance. It ensures compliance with national and local labour laws.

This model allows companies to hire in China without forming a local subsidiary. It reduces setup time. It limits long-term exposure. It also shifts compliance risk to a specialist.

China employer of record services are commonly used for small teams. They are also used for pilot operations. Many companies use them before committing to an entity.

Key Employer of Record Services in China

Employer of record services in China typically cover the following areas.

- Payroll processing and statutory deductions

- Tax filing and reporting

- Employment contracts and documentation

- Social insurance and housing fund administration

- Visa and work permit coordination

- Local HR support

Service depth varies widely. Some providers focus on payroll only. Others offer full lifecycle employment support. Understanding this difference is essential before selection.

Best Chinese Employer of Record Service Providers in 2026

Below is a comparative view of the China best employer of record providers based on market presence, service depth, and operational maturity.

Provider | Payroll & Tax Handling | Compliance & Benefits Coverage | Key Strength | Best Fit |

Deel | Automated payroll | Strong statutory compliance | Platform scale | Global startups |

Papaya Global | Centralised payroll | High compliance rigour | Multi-country visibility | Enterprises |

Safeguard Global | Managed payroll | Local HR depth | China experience | Mid-size firms |

Velocity Global | End-to-end EOR | Regional compliance | Asia focus | Expansion teams |

Globalization Partners | Full service | Strong benefits admin | Risk management | Regulated industries |

Horizons | Local payroll | China-specific expertise | On-ground presence | APAC teams |

INS Global | Payroll and tax | Flexible benefits | Regional customisation | Growth-stage firms |

New Horizons | Local handling | Strong local HR | China focus | Local hiring |

GoGlobal | Payroll support | Compliance advisory | Market entry | New entrants |

Infotree Global | Payroll accuracy | Local labour law depth | China specialisation | Long-term hiring |

Planning to Hire in China?

Explore verified China EOR providers with Peorient before making a choice.

Market Details for Hiring in China

China’s labour market is regulated at both national and local levels. National law sets the framework. Local authorities control execution.

Social insurance rates vary by city. Housing fund rules differ by region. Payroll cut-offs are strict. Reporting errors can trigger penalties.

Employment contracts must be in Chinese. Probation rules are tightly defined. Termination requires clear cause and process.

Foreign companies often underestimate these layers. This is where a strong China EOR becomes valuable. Local expertise reduces surprises.

Fun Fact: Social insurance contributions can exceed 30 percent of gross salary in some Chinese cities.

Why Hire Employees in China?

China remains relevant for companies that need scale and execution depth.

- The talent pool is large and experienced. Engineers and operations teams bring years of hands-on work. Manufacturing skills are well developed across regions.

- China sits at the centre of global supply chains. Local hires improve vendor coordination. They reduce delays and misalignment.

- Digital adoption is strong across industries. Teams are comfortable with complex tools and systems. This improves speed and accuracy.

- Local employees bring market insight. They understand customer behaviour and business norms. This supports sales and partnership roles.

These benefits depend on compliant hiring. An employer of record in China enables access without long-term structural risk.

Why Trust Our Reviews

Peorient operates as an advisory platform. Providers are reviewed against real use cases. Marketing claims are filtered out. Our listings reflect operational reality. We focus on compliance outcomes. Not brand popularity.

Feedback comes from expansion leaders. Issues are tracked over time. Updates reflect changes. This approach builds trust and avoids surface-level rankings.

Best Employer of Record in China: Pricing Comparison Chart

Pricing varies based on service scope, city, and employee profile. Below is an indicative comparison.

Provider | Indicative Monthly Cost (USD) | Visa Support | Payroll & WPS | Compliance Depth |

Deel | $600–$800 | Limited | Yes | Medium |

Papaya Global | $750–$1,000 | Yes | Yes | High |

Safeguard Global | $700–$900 | Yes | Yes | High |

Velocity Global | $650–$900 | Yes | Yes | High |

Globalization Partners | $800–$1,200 | Yes | Yes | Very High |

Horizons | $500–$750 | Yes | Yes | High |

INS Global | $600–$850 | Yes | Yes | Medium |

New Horizons | $500–$700 | Limited | Yes | Medium |

GoGlobal | $600–$800 | Yes | Yes | Medium |

Infotree Global | $550–$800 | Yes | Yes | High |

TIP: Always confirm whether housing fund administration is included in the base fee.

Reviews of the Best Employer of Record Services in China

Deel works well for digital-first teams. Its interface is intuitive. China coverage is improving, though less tailored than local providers.

Papaya Global suits enterprises with complex reporting needs. Its strength lies in consolidated payroll analytics across countries.

Safeguard Global brings long experience in China. It handles compliance details well. Local responsiveness is a key advantage.

Velocity Global focuses on Asia expansion. It balances speed with compliance. Client support is structured.

Globalization Partners emphasises risk management. It suits regulated sectors. Costs are higher, but coverage is deep.

Horizons offers strong China-specific expertise. It operates locally. This shows in payroll accuracy.

INS Global supports flexible hiring structures. It adapts benefits to business needs. It fits scaling teams.

New Horizons is China-focused. It works well for domestic-heavy roles. Global visibility is limited.

GoGlobal supports early market entry. It is advisory-driven. Operational depth varies by city.

Infotree Global specialises in China EOR services. It understands local labour nuances well. It fits long-term hiring strategies.

Other Chinese Employer of Record Services

Beyond global providers, several regional firms operate in China. These firms often focus on specific cities. They offer localised support. However, reporting and scalability can be limited.

These options suit companies with narrow hiring needs. They may not suit multi-city operations.

Hiring in China: Important Details

Hiring in China follows strict legal rules. These rules are actively enforced.

- Employment contracts must be localised. Chinese-language contracts carry legal authority. English versions are only for reference.

- Probation periods are tightly regulated. Duration depends on contract length. Errors can invalidate termination rights.

- Payroll follows fixed monthly cycles. Late salary payments trigger penalties. Tax filings are mandatory every month.

- Foreign employees need valid work permits. Job titles must match permit approvals. Any role change requires fresh authorisation.

These details leave little room for error. An experienced employer of record China partner manages them with consistency and care.

Selection Criteria for Employer of Record China

Choosing an EOR in China requires more than price comparison. Capability matters more than cost.

- Compliance depth should come first. The provider must understand national and local labour rules. This includes city-level variations.

- Payroll expertise is critical. Ask how salaries, taxes, and social contributions are handled. Errors here create immediate risk.

- Review city coverage carefully. Rules differ across locations. Housing fund administration should be clearly included.

- Support quality also matters. Confirm response times and escalation paths. Termination handling should be documented.

- Finally, assess exit flexibility. Understand how contracts transfer if you set up an entity later. This reduces long-term friction.

EOR vs Legal Entity in China

A legal entity offers control but demands commitment. It requires capital registration. It requires ongoing filings. It requires local accounting and audits.

An EOR offers speed and flexibility. Hiring can begin within weeks. Exit is simpler. Fixed overhead stays low.

The trade-off is control. Policies must align with local law. Some benefits are standardised. Certain incentives may be limited.

For early expansion, EORs often make sense. For long-term scale, entities still matter. Many companies move from EOR to an entity once operations stabilise.

When EOR Makes Sense | When a Legal Entity Makes Sense |

|

|

How to Choose an Employer of Record in China

A structured selection process reduces risk and prevents surprises later.

- Start by mapping your hiring needs. Identify roles, headcount, and target cities. This sets the scope early.

- Next, shortlist providers with direct China experience. Local depth matters more than global reach.

- Review employment contracts before committing. Ask for samples in Chinese and English. Check probation, termination, and notice clauses carefully.

- Then, examine service coverage. Confirm payroll handling, tax filings, and social contributions. Clarify what is included and what is not.

- Finally, assess how issues are handled. Ask who manages disputes and authority interactions.

A reliable employer of record China partner will be clear on the process and accountability.

Looking for EOR solutions in China?

Peorient offers hands-on guidance starting at $199.

Trends in Employer of Record Services

Employer of record models are evolving as compliance expectations rise.

- China’s EOR services are becoming more specialised. Providers now focus on city-level expertise. Local rule interpretation is a key differentiator.

- Automation is increasing across payroll and compliance. Reporting cycles are faster. Error tolerance is shrinking.

- Client expectations have also changed. Businesses demand transparency. Clear escalation paths are now standard.

- Audit readiness is no longer optional. China EOR providers are strengthening documentation and controls. The strongest ones invest in local teams, not just platforms.

Benefits of an Employer of Record Service

An employer of record in China offers clear advantages for global businesses.

- The first benefit is speed. Hiring can start within weeks. There is no need to set up a legal entity.

- Compliance coverage is another key benefit. Local experts handle payroll, taxes, and filings. This reduces regulatory risk.

- Flexibility is a major advantage. Teams can scale up or down quickly. Market testing becomes practical without long-term commitments.

- Cost predictability matters as well. Monthly fees are transparent. Hidden overhead and unexpected expenses are minimised.

Employer of Record Taiwan and Regional Context

Some companies compare employer of record China with employer of record Taiwan options. Taiwan offers simpler compliance. China offers scale. The choice depends on market goals. Many companies use both. Regional consistency matters.

Final Thoughts

China remains complex. That has not changed. What has changed is how companies approach risk.

An employer of record in China offers a controlled path forward. It enables hiring without heavy exposure. It supports learning before commitment.

The right provider makes this model work. The wrong one creates hidden costs.

How Peorient Helps You Choose the Right Employer of Record

Selecting an employer of record in China can be complex. Providers differ in compliance expertise, payroll accuracy, visa support, and local knowledge. These differences often only become clear after hiring begins.

Peorient simplifies this process. We provide clear comparisons of China’s EOR services. Our focus is on operational fit, not generic rankings or marketing claims. We guide you through provider shortlisting, evaluating trade-offs, and setting realistic expectations. This reduces guesswork and lowers the risk of choosing an EOR that does not meet your needs.

For businesses expanding into China, Peorient offers hands-on guidance starting at $199. We support you through the full selection process. This ensures clarity in decision-making.

Explore verified employer of record China providers with Peorient and make informed hiring decisions with confidence. Get Free Recommendations now!

FAQs

-

Is using an employer of record legal in China?

Yes. EORs must be registered local entities. They follow labour law, social insurance, and tax rules.

-

Can an EOR sponsor work visas in China?

Yes. Most providers handle work permits and visa applications. They ensure job titles and contracts meet local rules.

-

Is EOR suitable for long-term hiring?

Yes. It works well for small or pilot teams. Companies often transition employees to a local entity later.

-

How long does onboarding take?

Usually 2–4 weeks. Timing depends on the city, role, and work permit approval.

-

Are the benefits standardised?

Mandatory benefits include pension, medical, unemployment, and housing fund. Extra perks depend on the provider.

-

How is employee termination handled?

EORs follow local law. They manage notices, severance, and filings. Compliance is ensured, and risk is reduced.

Employer of Record China: Reviewed in 2026

Employer of Record services in China allow businesses to hire, pay, and manage employees compliantly without opening a local company.

-

Employer of Record China: Reviewed in 2026

January 20, 2026 -

Best Employer of Record UAE: Reviewed in 2026

January 12, 2026 -

Employer of Record Australia: Reviewed in 2026

January 9, 2026 -

Rippling vs. ADP: A Clear and Simple Comparison

January 6, 2026