Employer of Record France: Reviewed in 2026

Employer of Record (EOR) services in France help businesses hire and manage employees without setting up a local entity. EOR providers handle payroll, tax compliance, employment contracts, benefits, and French labor laws, enabling fast and compliant workforce expansion.

- February 16, 2026

Employer of Record France: Reviewed in 2026

Employer of Record (EOR) services in France help businesses hire and manage employees without setting up a local entity. EOR providers handle payroll, tax compliance, employment contracts, benefits, and French labor laws, enabling fast and compliant workforce expansion.

- February 16, 2026

France has a reputation for being one of the highest economic powerhouses in Europe, together with Germany and the UK. The nation offers numerous advantages to international companies wanting to grow, which include a highly skilled workforce, modern infrastructure, and being well-connected to the EU.

On the downside, the process of employee hiring in France can be difficult. A strict labour law system, detailed payroll regulations, and high social security contributions are among the major factors that render compliance a nightmare for foreign businesses. Legal, financial, or reputational risks may occur even from the smallest of mistakes.

To solve these problems, a lot of firms turn to an Employer of Record (EOR) solution in France. EOR allows companies to hire workers legally without having to set up a local entity, thus guaranteeing complete adherence to the French employment laws, while at the same time, lightening the administrative workload.

What Is an Employer of Record France?

An Employer of Record France is a third-party organization that legally employs workers on behalf of your company in France. The EOR becomes the legal employer on paper. Your company controls the employee’s daily work and performance.

The EOR handles:

- Employment contracts

- Payroll processing

- Tax and social security payments

- Compliance with French labor laws

This model allows companies to hire employees in France without opening a French subsidiary. It is legal and widely used by global businesses.

How Employer of Record France Works in 2026

The year is 2026, and EOR services in France are extraordinarily fast, very efficient, and predominantly digital, which, in turn, contributes to an entire recruitment process that is absolutely smooth and hassle-free. The journey begins when your company selects a suitable French candidate. At this point, the EOR creates a totally compliant French employment contract according to local labour laws. After that, the EOR officially hires the employee for you and incorporates them into your team very smoothly.

At the same time, the EOR takes over the total responsibility of HR management, payroll processing, tax filings, and continuous compliance. This set-up grants your company the legal right to operate in France without the administrative load. As a result, your business can focus more on the core growth strategies and day-to-day activities than being stuck with legal and labour complications.

Why Companies Use an Employer of Record in France

France has very strong labour laws that protect the rights of the workers, but the employers have to face the challenges created by these regulations, as even minor mistakes in compliance may lead to fines or lawsuits. To simplify the process, a lot of the companies prefer to use a France employer of record solution. The strategy allows them not only to avoid the setup costs and the time to create a local entity, but also to mitigate the legal risks, hire manpower faster and to gain a foothold in the French market with assurance.

Startups mostly depend on EOR services to explore the market, a trial run before deciding on the long-term commitment, while large corporations use them for the purpose of quickly increasing their workforce. In both scenarios, EORs make sure there is total compliance and operations are smooth without the burden of administration that comes with having a local entity.

Employer of Record France: Employment Laws & Compliance

French employment law is strict and detailed. Employers must follow the French Labour Code.

Key requirements include:

An EOR France ensures all legal rules are followed. It tracks law changes and applies updates automatically. This protects your company from fines and disputes.

Payroll Management Under an Employer of Record France

Payroll in France is complex. Authorities monitor it closely. Errors are easy to detect.

An employer of record in France manages payroll from start to finish. This includes salary calculations, payslips, and reporting.

Compliance Area | France Requirement (2026) | Handled by EOR | Risk if Self-Managed Incorrectly |

Employment Contract | Written contract in French (CDI or CDD) | Yes | Fines, contract invalidation |

Workweek | 35 hours standard | Yes | Overtime penalties |

Minimum Wage (SMIC) | Mandatory national minimum wage | Yes | Financial penalties |

Social Security Registration | Mandatory before employment starts | Yes | URSSAF sanctions |

Collective Bargaining Agreements (CBA) | Industry-specific rules apply | Yes | Back payments, disputes |

Probation Period Rules | Strict duration limits | Yes | Legal challenge risk |

Termination Procedure | Formal process required | Yes | Lawsuits, compensation claims |

Payslip Compliance | Detailed mandatory format | Yes | Payroll audit penalties |

An EOR ensures payroll accuracy and on-time payments. This reduces audit risk.

Taxes and Social Security Contributions in France via EOR

France has high social security contributions. Both employers and employees must contribute.

Contributions cover:

- Health insurance

- Pensions

- Unemployment insurance

- Family and housing benefits

An EOR services France provider calculates and pays these amounts correctly. It ensures compliance with all deadlines and rules. This removes a major burden from your business.

Employee Benefits Provided by an Employer of Record France

In the country of France, it is a legal requirement for employee benefits to be provided by companies, and they are expected to follow the law to that extent. Such mandatory benefits serve to provide protection to the workers, maintain their health and well-being, and cover them under social security, thus making compliance a major duty for all employers in France.

- Paid annual leave: Each year, workers in France have a legal claim to paid vacation days. Employees must have the right to relax and get paid; nonetheless, this will bear equilibrium to work life and personal life, without depleting resources.

- Public holidays: France has a number of national holidays as public holidays. Employees’ paid vacations on these days depend on their positions and agreements in the industry. It is mandatory for employers to adhere to the holiday regulations.

- Sick leave: Employees who are unable to work due to illness are entitled to sick leave. Income during this period is supported by the social security system and, in some cases, employer top-ups.

- Maternity and paternity leave: France offers very good leave for both new mothers and fathers. They can have income support during their time off, which means they won’t lose their jobs in case of family changes.

- Health insurance coverage: Health coverage is mandatory in France. Employers must contribute to employee health insurance plans alongside state social security coverage.

An Employer of Record France guarantees the proper administration and legal compliance for all these advantages as per French law. This not only allows companies to draw in the best-skilled workers but also helps in creating trust and retaining the employees.

Hiring Employees in France Using an Employer of Record

Hiring through an EOR is simple and fast.

The process includes:

- Candidate selection

- Offer approval

- Contract preparation

- Legal employment setup

With an EOR, companies can hire employees in France within days instead of months. This speed provides a strong competitive advantage.

Onboarding and Offboarding with an Employer of Record France

Onboarding in France involves several legal steps. These must be handled carefully.

An EOR manages:

- Employment documentation

- Payroll and social security registration

- Policy acknowledgments

Offboarding is sensitive in France. Termination rules are strict. An EOR ensures notice periods, final pay, and documentation are handled correctly. This reduces the risk of disputes or claims.

Employer of Record France Pricing and Cost Structure

EOR pricing in France depends on the provider and service scope.

Costs vary based on:

- Number of employees

- Role type

- Benefits required

- Contract complexity

Most EOR services France providers charge a monthly fee per employee. While this is an added cost, it is often cheaper than setting up and running a local entity.

Top Employer of Record France Providers in 2026

In France, there are a number of providers who are offering Employer of Record services, but it is very important to choose the right partner for long-term success. A trustworthy EOR must have an extensive knowledge of local compliance and a very good understanding of French labour laws to cope with the complex regulations efficiently. Moreover, it is crucial to pick a vendor that will provide transparent pricing with no undisclosed charges, guaranteeing financial clarity from the very beginning. Furthermore, reliable payroll systems are indispensable for the precision and promptness of the salary payments.

HR support with the full range of functions that includes recruitment, onboarding, employee queries, and termination will also be considered a plus. The right EOR partner will be the one that helps to reduce the legal and operational risks and, at the same time, provides regulatory compliance. Besides, it will also bring about employee satisfaction, thus making business operations in France smooth, efficient, and compliant.

Employer of Record France vs Setting Up a Legal Entity

Many companies compare EOR services with setting up a French entity.

Payroll Component | Approx. Responsibility | Managed by EOR |

Gross Salary | Employer obligation | Yes |

Employer Social Contributions | ~40–45% of gross salary | Yes |

Employee Contributions | ~20–25% deducted from salary | Yes |

Health Insurance Contributions | Mandatory | Yes |

Pension Contributions | Mandatory | Yes |

Unemployment Insurance | Mandatory | Yes |

Family Benefits | Mandatory | Yes |

Monthly Payroll Filing | Required | Yes |

For most companies entering France, an EOR is the faster and safer choice.

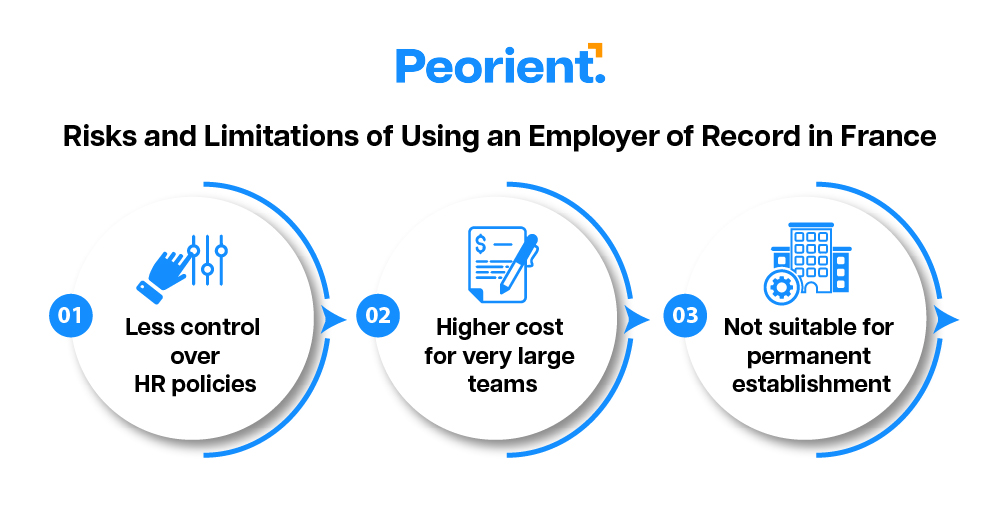

Risks and Limitations of Using an Employer of Record in France

EORs are not ideal for every situation.

Limitations include:

Companies planning long-term operations may later transition to a local entity.

When Is an Employer of Record France the Right Choice?

An Employer of Record France offers an excellent solution for companies that wish to hire swiftly while avoiding the hassles of local entity formation and full compliance with French labour laws at the same time. Moreover, it is the best option for companies that want to test the French market since it is a low-risk and flexible way to get into the market and discover growth opportunities. Under this scheme, firms can increase their labour force without having to make long-term commitments or incur high administrative costs.

The EOR will take care of all employment-related matters like contracts, payroll, compliance, and legal obligations, while the companies can concentrate on the areas of their interest, such as strategy, expansion and core operations, thus making the entry into the French market quicker and more efficient.

About Peorient

Peorient is a global workforce solutions provider. It helps companies hire and manage employees worldwide. Peorient offers reliable Employer of Record France services designed for speed and compliance.

Companies choose Peorient for strong compliance expertise, fast onboarding, transparent pricing, and dedicated HR support. With Peorient, businesses can expand into France with confidence and control.

FAQs

-

What is an employer of record France?

It is a provider that legally employs workers in France on your behalf.

-

Can I hire employees in France without an entity?

Yes. An employer of record in France allows this.

-

Is EOR legal in France?

Yes. EOR services are legal when structured correctly.

-

How fast can I hire using an EOR?

Most hires take 5–10 business days.

-

Can an EOR sponsor work visas in France?

An EOR does not issue visas but supports compliant contracts and documentation.

Conclusion

Recruiting staff in France is very advantageous in terms of growth; however, it also entails difficulties such as elaborate labour laws, hefty social security payments, and strict compliance rules. An Employer of Record France helps companies deal with the problems by allowing them to hire legally without the necessity of having a local company. This technique reduces compliance issues even further, reduces administrative work, and speeds up hiring considerably. The EOR takes care of payroll, contracts, and legal requirements, thus guaranteeing complete compliance with French regulations.

Consequently, companies can devote their efforts to business expansion while the operational hurdles are taken care of. The EOR model is a considered and versatile solution for both startups and large corporations that aim to efficiently and with confidence enter or expand in the French market.

Ready to hire in France without legal complexity?

Partner with a trusted Employer of Record France provider like Peorient and start building your French team quickly, safely, and compliantly today.

Employer of Record France: Reviewed in 2026

Employer of Record services in France allow companies to hire, pay, and manage employees compliantly without establishing a local entity.

-

Employer of Record China: Reviewed in 2026

January 28, 2026 -

Employer of Record China: Reviewed in 2026

January 20, 2026 -

Best Employer of Record UAE: Reviewed in 2026

January 12, 2026 -

Employer of Record Australia: Reviewed in 2026

January 9, 2026